Trade categories

Physical deals

Physical forward

Parties willing to buy or sell physical goods from or to each other at a future date, will enter into an agreement describing precisely the nature of the goods to be exchanged, delivery terms, price to be paid and settlement terms.

Real options

In physical trading, uncertainty on events, timing and price evolutions generate so called 'real' options. Real in the sense that those are not just financial artefacts, but rooted in production and logistics, options because solving them entails probability assessments and mathematical tools used in the evaluation of financial products.

- Transport

- A simple option on the difference between prices in two locations

- Sold as a strip

- Incorporates a loss rate

- Tricky to model, as correlation is close to 1, yet poorly known.

- Load serving deals

- Power utilities would like to hedge not just the power price, but the demand as well, because they cannot refuse to serve.

- The load is also highly correlated with the power price, as well as with weather, and with long term economic growth.

- There is no market data in load, so crude models are marked to historical data

- There are no satisfactory models of load

- Production spreads

Payoff is the difference between outcome and fuels entered in the production process:- Crack spread: in a refinery, between refined products and crude oil

- Dark spread: in a power plant, between power and coal

- Spark spread: in a power plant, between power and gas

- Crushing spread: in a power plant, between oil + meal and beans or grains

- Swings

- This is an option to hedge out the flexibility that a customer has in buying natural gas

- A customer contracts to buy a certain quantity of natural gas over a series of periods. He has the option to take a certain amount each day, at the floating rate. He must buy at least a minimum amount within the period, or there are penalties. There is rebating in the next period if he buys more than the maximum in a period.

- This has a lot of optionality, and is very time-consuming to evaluate, even in a simple model.

- Storage

- A user is rented a storage tank. He has the option each day to buy natgas and inject into the tank, or withdraw and sell natgas from the tank, or do nothing.

- He pays operating feed to inject or withdraw.

- He must return the tank at some level of fill.

- He has a daily injection limit and a daily withdrawal limit.

- This has a lot of optionality, and is very time-consuming to evaluate, even in a simple model. Close to swing.

Derivatives

The sequence starts with an agreement between buyer and seller to deliver physical goods on a forward date. The market risk associated with this physical forward will usually be hedged, by entering into derivatives trades, taking opposite financial positions. Those may include options, to cater for uncertainty (volume swings) or reduce the hedging cost. Options can have exotic features, to obtain specific pay-off profiles. And several trades may be structured together, to cover risks of different natures (e.g. multi-currency) or facilitate trade execution (e.g. position roll-over).

Categorization

One normally does not want to remain exposed to the market risk resulting from the contracted physical forward trade and will enter into financial trades to hedge the original position. It reduces outright price risk to basis risk, the price differential. The paradigm being that the price of the physical and financial instrument remain strongly correlated, which for futures is guaranteed by the ability to physically deliver the future at expiry. Would the basis increase or decrease, arbitrage would detect it, and very quickly bring them back in sync.

Hedging will usually happen in cascading mode:

- A physical position is first hedged by the physical trader with an instrument hooked an index close to the pricing index of the deal. The many hedge requests (orders) issued by the physical desks may be directed to a central execution desk.

- The execution desk will first detect the internal offsets (one desk wants to buy, another wants to sell same delivery, same tenor), consolidate them and calculate net positions and finally hedge them in the market. Doing this it can decompose or translate risk, expressing it in equivalent instruments which may be more liquid and cheaper to trade. This requires permanent monitoring because market conditions and correlations between curves change continuously and hence the relevance of the hedge.

One can hedge in many ways, depending on the corporate risk policy, the trader's view on the market, accounting standards, etc. The major categorization is made along following lines:

Linear or Optional

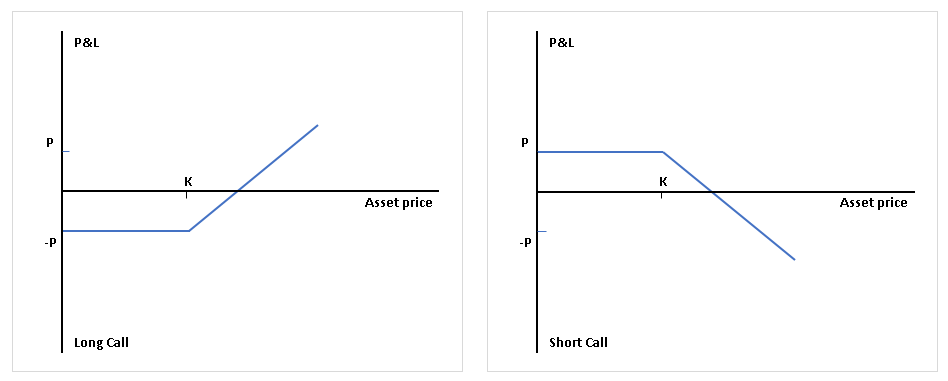

An option is a contract that gives the holder (buyer) the right, but not the obligation, to buy (call) or sell (put) the underlying instrument at a specified price (strike), on (european) or before and until (american) a specified date in the future (exercise date). This right is granted by the writer (seller) who receives upfront a certain cash amount (premium) for it.

The profit or loss on a trade is the difference between mark to market of the exchanged underlying at delivery and traded price at inception. Profitability depends on how the price curve evolves. For linear instruments (futures, swaps) the risk equals the traded quantity because the profit or loss per unit will be multiplied by deal nominal. The holder of an option may abandon or exercise it, depending if the price has evolved in his favour or not. When evaluating options, one does not only consider the underlying price curve, but as well its volatility, or how erratic the curve movements are around its mean. The risk of an option equals thus a probability weighted trade quantity, which at exercise will become all or nothing.

Unpredictability of the physical markets triggers the need to trade options:

- Your client commits for a firm quantity but may be willing to take more or less depending on the demand of his own customers.

- Your client may want to budget a purchase price within a given boundary of floor and ceil strikes.

- Anticipating favourable or unfavourable price movements, your customer may want to lock prices in advance.

Listed or OTC

A difference in trading venue, which issue very different risk profiles.

Derivatives categorization

Fundamentally all commodities deals are swaps, one receives one leg and pays the other one. Depending on the leg attributes they are often categorized as follows:

Trade datamodel

In the Datamodel paragraph 🔎, we detail the outline of the most relevant trade attributes. Only a subset of those are sufficient to be able to value a trade, as briefly detailed hereafter.

Linear deals

Options

Option definitions

An option is a contract that gives the holder (buyer) the right, but not the obligation, to buy (call) or sell (put) the underlying instrument at a specified price (strike), on (european) or before and until (american) a specified date in the future (exercise date). This right is granted by the writer (seller) who receives upfront a certain cash amount (premium) for it. Some terminology:

- The difference between the current price of the underlying asset and the option strike is the intrinsic value of the option. If the intrinsic value is positive, an option is said to be in the money (ITM), if zero, at the money (ATM), if negative, out of the money (OTM).

- Between current date and expiry, price of the underlying will shift. The probability of underlying price movement increases with volatility of the underlying asset (predictability) and time to expiry (time to go). Investors are ready to pay something on top of the intrinsic value of the option, to account for the likelihood that the underlying price moves in the favourable direction, in other words that the option will be more ITM than today. This is called the time value of the option.

- The premium one is ready to pay for an option in theory cumulates intrinsic value and time value of the option.

Evaluating the fair value of an option thus consists of calculating for a call, the expected value of the underlying at exercise minus the strike, for a put, the strike minus the expected value of the underlying at exercise.

The theoretical price or premium of most options are calculated by the Black-Scholes model, or an amended version of it. This model gives a fair value for options in function of:

- Current price of the underlying asset

- Strike

- Time to expiry

- Risk free interest rate

- Volatility of returns of the underlying asset, which is the only parameter which is not unequivocally observable

Out of premia paid for options and the market price of the underlying asset, one can deduce the volatility. This implied volatility is the volatility of the underlying which passed to the model, will give a theoretical fair value of the option equal to the premium paid for that option.

Implied volatility is determined by the market price of the option contract itself, and not by statistics on the prices of the underlying. Hence it is function of the supply and demand dynamics of the options market. It is a forecast of future volatility made by traders and acts as an indicator of the current market sentiment about volatility.

According to Black–Scholes, the implied volatility of an asset should be the same for all strikes and maturities. By computing the implied volatility for traded options with different strikes and maturities, it appears that the volatility surface (the 3D graph of implied volatility against strike and maturity) is not flat. Premia paid for options are not equal to their theoretical fair values.

Traders factor in that 'eccentric' derivatives (deep OTM) bear more risk than ATM or ITM options. For a given maturity, the more out of the money, the higher the premium. If symmetrical, the 2D graph plotting implied volatility against strike or moneyness, looks like a smile. If not, the implied volatility is said to be skewed (asymmetry from a normal distribution).

Exotic options

Treasury deals

Trades of different categories can be structured together to obtain a combined pay-off to answer specific demands. Structures often encountered in commodites trading are detailed below.

Put