Oil

Fundamentals

Production and consumption data can be found in the statistical figures released by:

| Site | Organization |

|---|---|

| BP | BP - Statistical Review of World Energy |

| EIA | US Government - Energy Information Administration |

| IEA | International Energy Agency |

| UN | UN - Industrial Commodity Statistics Yearbook |

Products

The oil chain covers the large variety of crudes drilled all over the world, the multiple refined products yielded out of crude, as well as the various biofuels, which due to environmental concerns, now complement gasoline to fuel motors of automotive vehicles.

Crude oil

Crude oil or petroleum ('stone oil') is a mixture of fossil hydrocarbons found beneath the Earth surface. It is extracted through drilling.

Due to its high energy density, easy transportability and relative abundance, oil has become the world's most important source of energy since the mid-1950s.

Petroleum is also the raw material for many chemical products.

Crude oil results form fossilized organic material transformed to gasses and liquids through heat and pressure during millenary geological transformations. Qualities of crudes are thus very heterogeneous. Many characteristics are measured (detailed by producers in a crude oil assay for refiners and traders), among which some of the most discriminating in terms of merchant value of oil are: origin, density and sulfur content.

The many grades of crudes are most times categorized by origin (field, load terminal) or quality (with density and sulfur content as most salient characteristcs). Grading buckets may vary between classifications

Refined products

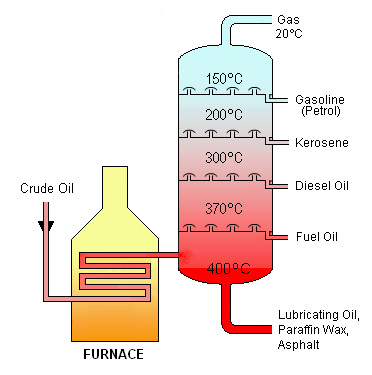

Refinery process

Crude oil is refined and processed into more useful petroleum products. Different boiling points allow the hydrocarbons to be separated in different fractions by distillation. To obtain more of the lighter liquid products which are in greater demand, heavier viscous fractions will be cracked into shorter hydrocarbon chains, smaller gazeous molecules recombined into longer liquid chains. Depending on the grade of the incoming crude, refining practices, processing capabilities and desired output, each of those products will be of a certain quality.

| Crude oil distillation schema |

||||||||||||||||

| Distilation Temp. (°C/°F) |

Intermediates (Carbon chain) |

Products | Inherent yield LSW | MSR | HSR (pct) |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Atmospheric distillation | < 30° ⇒ < 90° |

Petroleum gases C1-C4 |

⇒ |

|

Gases 3.0 | 2.0 | 1.0 |

|||||||||||

| 30-100° ⇒ 90-220° |

Straight run gasoline C5-C8 |

⇒ |

|

Gasoline 32.0 | 24.0 | 15.0 |

||||||||||||

⇒ |

Reformer | |||||||||||||||

⇒ |

Desulfurization | ⇒ |

||||||||||||||

| Crude | 100-160° ⇒ 220-315° |

Naphta C8-C12 |

⇒ |

|||||||||||||

⇒ |

|

Distillates 30.0 | 26.0 | 21.0 |

||||||||||||||

⇓ |

||||||||||||||||

| 160-230° ⇒ 315-450° |

Kerosene C12-C30 |

⇒ |

||||||||||||||

| Furnace | ⇒ |

|||||||||||||||

| 230-340° ⇒ 450-650° |

Gasoil light C30-C50+ |

⇒ |

Hydro cracker | ⇒ |

||||||||||||

⇓ |

⇑ |

LCO | ||||||||||||||

| Vacuum distillation | 340-425° ⇒ 650-800° |

Gasoil heavy C30-C50+ |

⇒ |

FCC | ⇒ |

Alkylation | ⇒ |

|

||||||||

⇑ |

||||||||||||||||

| > 425° ⇒ > 800° |

Residual fuel, Bitumen C50-C100+ |

Coker | ||||||||||||||

|

Heavy residues 35.0 | 48.0 | 63.0 |

|||||||||||||||

Products

Grading

The characteristics under scrutiny obviously vary per product. Specifications and tolerance levels can be different per country, region or even season and evolve in time (e.g. more stringent environmental regulations). Markets and regulators often classify products according quality. The most relevant measured characteristics are briefly summarized below.

Grades

Fuel oil

The standard specifications for fuel oil prevailing in the US is detailed in ASTM-D396.

Marine fuel

There are two basic types of marine fuels: distillate (D) and residual (R), plus a third type which is a mixture of these two, commonly called intermediate (IFO).

The standard specifications for marine fuel oil worldwide is detailed in the ISO 8217 specifications.

Gasoil

Gasoil or Diesel is used mainly to fuel automotive compression-ignition engines.

The standard specifications for diesel fuel oil prevailing in the US is detailed in ASTM-975.

Gasoline

The grades are a combination of product and octane number. For each combination, the minimum RVP will vary seasonally (usually 9 in summer, 15 in winter). In the transition weeks, both the 'prompt' volatility and a 'supplemental' RVP are quoted simultaneously. Commercial buckets and corresponding specifications will vary per country.

The standard specifications for gasoline prevailing in the US is detailed in ASTM D910.

Biofuels

As for other hydrocarbons, the energy of biofuels stems from carbon fixation, however not fossilized but converted from biomass which is biological material from living, or recently living organisms. Biofuels are gaining attention for various reasons: concerns about energy security, reduction of greenhouse gas emissions, economic outcome for agriculture production or by-products. Biofuels ![]() can be used as such but are usually blended as additives with fossil fuels (diesel, gasoline) to improve combustion (octane rate) and reduce greenhouse gas emissions. The most common types of biofuels are:

can be used as such but are usually blended as additives with fossil fuels (diesel, gasoline) to improve combustion (octane rate) and reduce greenhouse gas emissions. The most common types of biofuels are:

- Biomass used directly (wood logs or chips) or to produce methane (agricultural waste, manure).

- Bioethanol an alcohol made by fermentation of mostly carbohydrates produced in sugar or starch crops such as corn, sugarcane, or sweet sorghum. Most widely used in the Americas (USA, Brazil).

- Biodiesel is produced from oils or fats using transesterification. Most common biofuel in Europe.

The US Environmental Protection Agency (EPA

The four renewable fuel standards are nested within each other. This means, the fuel with a higher GHG reduction threshold can be used to meet the standards for a lower GHG reduction threshold. For example, excess fuels/RINs for cellulosic biofuel (D3) can be used to meet the requirements of advanced biofuel (D5), which in turn can be used for conventional renewable fuel (D6) requirements.

| D6 Conventional renewable fuel |

||||||

| D5 Advanced biofuel |

||||||

| D3, D7 Cellulosic fuels |

D4 Biomass based diesel |

|||||

Geography

Crude oil is traded where it is produced, along its transport lines or where refined: off-shore loading faciltities, exit points of pipelines, pipeline hubs or large refining platforms, often part of or close to large maritime harbors.

Refined products are traded where produced or consumed or along transport lines: refinery platforms, harbors or pipeline hubs close to large consumption pools.

Depending on carrier a distinction is made between waterborne and pipe. Price assessments are released usually for a given 'market', a larger region often encompassing many possible delivery locations, normalized to the most liquid of them.

In the US, the Energy Information Administration (EIA) clusters products movements data according PADD districts (Petroleum Administration for Defense Disticts, dating from World War II). Those districts are often used when releasing US energy data based on geography.

- Crudes map

- Map of major trading hubs for refined products.

- US pipelines for refined products.

Markets

Crude

Crude being the feedstock to the entire oil industry and a major source of energy, is obviously actively traded. Most pricing however happens around very few price benchmarks or markers ![]() , the 3 primary ones being Dubai, Brent and WTI. As such they do the ‘heavy lifting’ for price discovery, enabling other grades to be traded in reference to those most liquid instruments. Those benchmarks evolved from local entities to become global assets, though are still subject to their local fundamentals as well as global ones: they became global brands. Their underlying physical and geographical content as well evolve and from single source they became composite baskets, mixing different streams, following as such how market fundamentals are changing.

, the 3 primary ones being Dubai, Brent and WTI. As such they do the ‘heavy lifting’ for price discovery, enabling other grades to be traded in reference to those most liquid instruments. Those benchmarks evolved from local entities to become global assets, though are still subject to their local fundamentals as well as global ones: they became global brands. Their underlying physical and geographical content as well evolve and from single source they became composite baskets, mixing different streams, following as such how market fundamentals are changing.

Those benchmarks prices are cascading through the entire oil valuation chain. Mechanics of price relations between crudes themselves, of crack spreads between the primary crudes and the major futures for refined products, and location, quality or calendar spreads between products, make all prices of the oil industry interdependent, but all anchored to those primary crude benchmarks.

All key crude benchmarks, are futures exercised physically, whereby buyers and sellers may elect to take or make delivery of physical oil. The physical-delivery requirement provides a direct link to the underlying physical market, ensuring the convergence of futures and cash prices, whereby futures also provide the security of a financially-guaranteed clearinghouse for buyers and sellers.

Speaking of 'markets' for crude, there is a habit of reasoning 'East of Suez' and 'West of Suez'. Many crudes are quoted at a spread against a benchmark crude. There are two global benchmarks: Brent (North Sea) and West Texas Intermediate (US Gulf), and a regional one: Dubai (Middle East).

Indonesian crudes

Dubai

Dubai crude is a heavy sour crude oil extracted in the UAE. For many years it was the only freely traded oil in the Middle East, but gradually a spot market has developed in Omani crude as well. Most of the oil producers in the Middle East have taken the monthly spot price average of Dubai and Oman as the marker for sales to the Far East, where Brent and WTI were used for exports to the Atlantic.

Change in ownership and decline in output of Dubai fields resulted in methodology adjustment. Dubai has turned into a brand, or index, that represents a basket of Middle Eastern mid-sour grades (Dubai, Oman, Upper Zakum). ... Dubai still constitutes the main benchmark for pricing oil cargoes destined to Asia.

The Dubai Mercantile Exchange (DME ![]() ) proposes a future contract on Oman crude, and Platts releases a Dubai quote for up to 3 months forward, which underpins a Dubai 1st Line future contract listed on DME, ICE and Nymex.

) proposes a future contract on Oman crude, and Platts releases a Dubai quote for up to 3 months forward, which underpins a Dubai 1st Line future contract listed on DME, ICE and Nymex.

North Sea

Brent is one of the first oilfields exploited in the North Sea, back in the late 1970s. It became the physical deposit underlying the crude futures contract developed in 1988 by the International Petroleum Exchange (IPE) which is now ICE Futures Europe. As such its price started to be adopted as a major benchmark for crude oil prices, in the Atlantic bassin and even worldwide. ICE estimates that 2/3 ow world's crudes are priced against Brent.

As the production of the original fields depleted and to expand liquidity, other nearby fields have been included in what is now the North Sea or BFOE basket, still often referred to as 'Brent'. The basket composition may still evolve, depending on fields output, but continues to be hooked on the North Sea physical cargoes market.

Other crudes flow into the 'Brent basin' or home market, which is comprised roughly of Europe (North West, Med), the Mediterranean coast of the Middle East, North and West Africa. Most of those will be priced according a formula hooked on Brent prices (Dated or ICE 1st Line). The most relevant ones are detailed hereafter.

Urals

CPC

West African grades

Between Dated Brent, which covers the physical spot market, and the financial Brent future, which 1st line or prompt maturity, hedges delivery within 2 months, various other quotes are available to cover the nearby North Sea crude complex. The chronology is schematically detailed here. Some more disentanglement:

Dated

There is an established mechanism for moving from the forward to the physical market. A producer agrees a month-ahead forward contract with a refiner for a specific contract month. The field operator of one of the specified fields announces the loading dates month-ahead before the month starts to be wet. Equity producers can either start nominating their cargoes or they can keep them. When a buyer is passed a cargo, they can choose to keep it or pass it along, creating a chain with whomever they have a month-ahead contract with. If the cargo is nominated on-time the buyers must accept the cargo offered. Once the deadline for nominating a cargo has passed, the cargo turns physical and it can then be traded as Dated Brent cargo as precise loading dates will be attached to that cargo. The spot, or physical, market for Brent is called Dated Brent, referencing the value of spot cargoes trading in the North Sea. Several different crude grades underpin Dated, which vary in quality and price. An adjustment mechanism enables these grades to be assessed to a standardised specification in term of quality. The cheapest of the underlying grades is used to determine the value for Dated Brent.

Dated thus reflects the value of spot, physical cargoes loading 10 days forward till one month ahead from publication date (prompt delivery). Those cargoes are 'dated', i.e. they have already been assigned a loading date range for a named vessel, FOB at each respective loading terminal.

To norm all grades to a standard Sulfur content (max 0.60 pct), the quality premium (QP) observed in the market is subtracted from the values of Oseberg and Ekofisk, and a quality discount (sulfur de-escalator) is added to Forties values (all addends being reviewed monthly). On every single day of the assessment range, the most competitive price of all four 'adjusted' grades (BFOE) is retained. Hence for the grades contributing to Dated, the price for a cargo loading at their respective terminals, is not strictly equal to the value as basket constituent, which is the quality adjusted cargo price.

Prices of physical cargoes for each of the BFOE grades at their respective terminal for the same loading range (10-M+1) are released as well.

Strip

Physical cargoes of crude oil typically trade as a differential to a benchmark like Dated Brent, with pricing calculated at or near the time of loading. By applying the agreed differential to the assesment of the benchmark, one can obtain a good estimate of the outright contract price. The assessed strip of the underlying, should however correspond to the prevailing loading range and pricing formula. Those vary in different geographical areas.

To provide a pricing basis benchmark close to the prevailing load ranges, Platts, provide different strips of Dated Brent assessment. Platts will apply observed, tradable forward Dated Brent values, derived from relevant markets, such as BFOE CFDs and BFOE DFLs, applicable to and typical for each grade. This provides Platts with an anticipated forward value for Dated Brent that is in line with the loading period for each individual crude grade.

BFOE Cash

The Cash or Forward (North Sea flat price) reflects a volume weighted average of outright prices of North Sea forward trades. Each trade is a cargo with physical delivery during the specified contract month. The tradeable value for both partial cargoes (minimum size 100,000 BBL) and full cargoes (600,000 BBL) are assessed. Those are short term (next 3 months) forward assessments. Assessment for the M1 forward (loading any date in M+2) closes on the last business day of current month.

CFD, Swap

CFDs (Contract For Difference) are short–term swaps, assessed for each of the six (Argus) to eight (Platts) weeks ahead of the current date at any one time. They represent the price differential between the forward month BFOE Cash (Mo02 for Platts, PCAAR00) assessment for next delivery month and the anticipated Dated Brent assessment for the corresponding week.

Future, EFP, Brent index

The North Sea complex is the underlying market to ICE's Brent future contract. The contract is is a deliverable contract based on EFP delivery with an option to cash settle, against the ICE Brent Index on contract expiry date.

The ICE Brent Index ![]() is a calculation performed by ICE, to represent the average price of trading in the BFOE (Brent-Forties-Oseberg-Ekofisk-Troll) cash or forward (‘BFOE Cash’) market in the relevant delivery month as reported and confirmed by the industry media (in this case ICIS

is a calculation performed by ICE, to represent the average price of trading in the BFOE (Brent-Forties-Oseberg-Ekofisk-Troll) cash or forward (‘BFOE Cash’) market in the relevant delivery month as reported and confirmed by the industry media (in this case ICIS ![]() ).

).

Another index released by ICE is the BWave (Brent weighted average) index, which is the weighted average price of all trades of Brent crude oil across an entire trading day. This index is often embedded in price formulas for crudes exported from Persian Gulf countries.

ICE offers an EFP (Exchange Future for Physical) ![]() mechanism, which enables participants to exchange their futures positions for a physical position. An EFP trades at a differential between the futures and the underlying physical market price of equivalent month. EFP prices are also considered by both pricing reporting agencies when assessing the North Sea Forward price, certainly when liquidity in the cargoes market is sparse. The EFP market ensures a real convertibility between physical and futures markets.

mechanism, which enables participants to exchange their futures positions for a physical position. An EFP trades at a differential between the futures and the underlying physical market price of equivalent month. EFP prices are also considered by both pricing reporting agencies when assessing the North Sea Forward price, certainly when liquidity in the cargoes market is sparse. The EFP market ensures a real convertibility between physical and futures markets.

Canadian crudes

Canadian crudes are quoted as 4 different indices, permutations of 2 distinct observation windows for price fixing and 2 types of averaging.

Those are traded on two Exchanges, NE2 and NGX, which underpin respectively the Nymex and ICE contracts.

US crudes

WTI

West Texas Intermediate (a blend of several streams of US domestic light sweet crude oil) is listed on Nymex (now part of the CME group) since 1983. It's underlying cash market is crude oil exchanged at Cushing (OK), a vibrant hub with a network of pipelines, refineries, and storage terminals. As the hedge contract of choice of world's largest economy for decades, WTI has always had a global reach. This becomes even stronger, following the sharp rise of US LTO production (Light Tight Oil, also called shale oil or unconventional oil), whereby crude export ban has been lifted in 2015, and the US becoming a net oil exporter. Massive pipeline capacity has been built between a landlocked Cushing, and the US Gulf Coast, together with new storage and takeaway facilities along the coast. Infrastructure transformed WTI into a waterborne crude, with extensive export capacity, able to compete directly in the global marketplace. This also leads to a diversification of the WTI based contracts, based on geography, whereby Cushing continues to serve domestic refineries and Houston the waterborne export markets, but based as well on new crude streams, of distinct grades, reaching the Gulf Coast.

At Cushing, extra pricing points are considered:

-

Formula

For US pipelines, shipments must be scheduled no later than the 25th day of the preceding month. In the event that the 25th falls on a weekend or holiday, the pipeline scheduling deadline moves forward to the first business day before the 25th. The Nymex WTI contract is aligned with this scheduling, whereby the front-month future expires three business days prior to the scheduling deadline.

On the 26th preceeding the front-month the shipments for this month start. What is scheduled is also priced. However for the 3 days between Nymex expiry and scheduling deadline, Argus applies a formula whereby trades done for the Month-One/Month-Two WTI Cushing cash roll throughout the day are averaged on a volume-weighted basis. The resulting Cash Roll average is then applied to that day’s price for WTI Nymex prompt month settlement, in order to derive the first-month WTI Cushing value. The formula kind of extrapolates the WTI Cushing front month price, between Nymex expiry and scheduling deadline, based on postings for Cushing delivery done during that period.

-

P-Plus

P-Plus deals are posted for delivery in the window considered by reporting agencies, but are invoiced at a later date on the basis of a differential to an average of one or more crude oil postings. A deal done at P-plus would thus be invoiced at a spot premium to the originally agreed-upon postings.

At Houston, Argus calculates a composite index for medium-sour crudes tradeable along the US Guld Coast:

-

ASCI

The outright Argus Sour Crude Index (ASCI-VWA) is calculated by adding the ASCI differential index to the Argus WTI Formula Basis. The differential ASCI index (ASCI-Diff) is deduced daily from deals on the component crude grades (Mars, Poseidon, Southern Green Canyon) done for prompt month delivery to the US Gulf. Deals are posted at a price differential to the front-month Nymex crude contract. The differential index is the daily volume-weighted average of those differentials.

is calculated by adding the ASCI differential index to the Argus WTI Formula Basis. The differential ASCI index (ASCI-Diff) is deduced daily from deals on the component crude grades (Mars, Poseidon, Southern Green Canyon) done for prompt month delivery to the US Gulf. Deals are posted at a price differential to the front-month Nymex crude contract. The differential index is the daily volume-weighted average of those differentials.

Pricing of US crudes typically feature following observation patterns:

Refined

Biofuels

Europe

United States

In the US, the Energy Independence and Security Act (EISA ![]() ) was enacted in 2007 and enforced since 2010 the Renewable Fuel Standards (RFS

) was enacted in 2007 and enforced since 2010 the Renewable Fuel Standards (RFS ![]() ). The process is administered by the U.S. Environmental Protection Agency (EPA

). The process is administered by the U.S. Environmental Protection Agency (EPA ![]() ).

).

The Renewable Fuel Standard is a federal policy that mandates the incorporation of renewable fuels into the nation’s transportation fuel supply, to replace or reduce the quantity of petroleum-based fuel. Each year (compliance period), the EPA issues RFS rulemakings with volume requirements for certain renewable fuel categories and sets those volumes through annual renewable volume obligations (RVO). RVOs are the volumetric biofuel targets for obligated parties (OP) such as refiners and importers of petroleum-based gasoline or diesel fuel. RVOs are calculated as percentages across the four categories (the D codes 🔎) of RFS biofuels targets. Obligated parties multiply these percentages by the volume of petroleum-based gasoline and diesel fuel they produced or imported to determine their specific renewable fuel obligations for that calendar year. Renewable fuels production and consumption are tracked by Renewable Identification Numbers (RIN ![]() ). They are credits used for compliance, and become the currency of the RFS program.

). They are credits used for compliance, and become the currency of the RFS program.

- A RIN is assigned to a gallon of qualifying renewable fuel once it is produced or imported.

- The RIN is separated once the renewable fuel is blended with gasoline or diesel.

- A separated RIN may be submitted for compliance, traded, or banked for future use.

- Obligated parties and renewable fuel exporters obtain RINs and then ultimately retire them for compliance.

RINs can be traded in two forms:

- Assigned RINs - Created when a batch of renewable fuel is produced or imported. Directly associated with a batch of fuel and travels with that batch of fuel from party to party. Purchasers obtain both the renewable fuel and RINs together.

- Separated RINs - Released once the renewable fuel is blended into gasoline or diesel in the US. RINs are no longer assigned to a batch but become tradeable as credits. Obligated Parties purchase RINs from the market and retire those to fulfill their RVO.

In the EPA Moderated Transaction System (EMTS), companies maintain RIN accounts by D-codes and RIN year (the year in which the RIN was generated or vintage year). RINs are retired for compliance by obligated parties based on their RVO and exporters. RINs not retired for compliance can be carried over into the next compliance year (running from 1st Jan of the vintage year till 31st March of the following year). RINs are only good for satisfying obligations for the current compliance year or the following compliance year . After that, the RINs expire and can no longer be used for compliance purposes.

A RIN is a credit equivalent granted at production or import of a renewable fuel. The equivalence value (EV) of a renewable fuel represents the number of gallons that can be claimed for compliance purposes (RIN gallons) for every physical gallon of the fuel. It is based on the energy content of each renewable fuel relative to ethanol, as determined by EPA (paragraph §80.1415

The formula to calculate the EV is:

|

\( EV = \frac{R}{0.972} \times \frac{EC}{77000} \) |

Whereby:

|

Shared

- MIC, Market Identifier Code, according norm ISO 10383

- Calendars, as provided by Financial Calendar

The swap structures traded, depending on markets, can have several observation (fixing) windows. Oil contracts typically trade according following patters.

To be built

Octane rating is a measure of how steady a fuel can withstand compression before detonating (igniting). Lower octane number may lead to ignition earlier than expected, called engine knocking, which reduces fuel efficiency. This measure matters particularly for gasolines, crafted for motors where air and fuel are compressed together (requiring high compression ratios) as a mixture which is ignited at the end of the compression stroke. Unlike diesel engines, where it is not the fuel, but air which is compressed (which heats it up) and fuel injected into it. Hence octane rating is less relevant for diesel fuels.

Depending on the measurement method, one distinguishes between Research Octane Number (RON), Motor Octane Number (MON), and the average of both measures which is called Anti-Knock Index (AKI), Posted Octane Number (PON) or simply (R+M)/2.

In most countries the headline octane rating shown on the pump is RON. In Canada, the United States, Brazil and some other countries the headline number is the PON. The MON generating a lower number than the RON, octane rating in those countries will usually be 4 to 6 numbers lower than elsewhere in the world. Typical grades:

| Grade | (R+M)/2 | RON |

|---|---|---|

| Sub-octane | < 83 | |

| Regular | < 87 | < 91 |

| Mid-grade | < 93 | < 95 |

| Premium, Super | > 92, 93 | > 97, 98 |

Gasoline is composed of many different hydrocarbons. Crude oil enters a refinery, and is processed through various units before being blended into gasoline. A refinery may have a fluid catalytic cracker (FCC), an alkylate unit, and a reformer, each of which produces gasoline blending components. Alkylate gasoline is valuable because it has a very high octane, and can be used to produce high-octane (and higher value) blends. Light straight run gasoline is cheap to produce, but it has a low octane. Butane is cheap but icreases the RVP of the mix. The person specifying the gasoline blends has to mix all of the components together to meet the product specifications. The resulting mix must have, among other requirements, the right octane number and the right RVP level.

Of particular importance in the mix are oxygenates. Oxygenates contain oxygen which when mixed as an additive to gasoline, improves hydrocarbons combustion, hence reduces emission of toxic carbon monoxide, ozone-forming pollutants and soot. MTBE (Methyl tert-butyl ether) is still used as an oxygenate, but environmental concerns, have convinced regulators (EPA in the US) to rather mandate ethanol.

To accomodate more stringent environmental protection regulations, the fossil mineral fuels sold have evolved as well. Several of them will be blended with renewable fuels prior to filling engines. They are blendstocks, which will be blended with:

Ethanol is a renewable fuel, obtained mainly by fermentation of crops and biomass. It has a cleaner combustion but a lower energy density than fossil fuels. It increases the blend's octane number but reduces its RVP. A car can drive on 100% ethanol, but most flex-fuel vehicles are designed to run on 0% to 85% ethanol (E85). In the US, oxygenated blends typically contain up to 10% ethanol (E10). Ethanol's high miscibility with water acts as a solvent which makes it too corrosive for steel and thus unsuitable for shipping through pipelines. It has to be stored in special tanks, and blending happens at local terminal racks as the tanker truck fills or at the pump itself.

Biodiesel is a renewable fuel, obtained by reacting vegetable oil or animal fat with alcohol to produce fatty acid esters. It is blended with diesel fuel in various proportions (B factor), to enhance combustion and hence reduce emissions of unburned hydrocarbon compounds and pollutants from automobile exhaust.

Reid vapor pressure is a measure of the volatility of gasoline, defined as the vapor pressure exerted by a liquid at 100°F (37.8 °C).

High levels of vaporization are desirable for winter starting and operation and lower levels are desirable in avoiding vapor lock (can impede combustion) during summer heat. Refineries thus manipulate RVP seasonally to maintain reliability of the engines gasoline fuels. In the US, typical values range from 7 to 15 psi, with a medium at 9 psi.

RVP is related to the presence of volatile organic compounds (VOC) in the fuel. Those molecules with low boiling point, evaporate or sublimate and enter the surrounding air, trait known as volatility. Temperature increases the volatility of a fuel. During hot months, evaporation not only pollutes the atmosphere with VOCs, but the pressure resulting from it may become hazardous. Hence the regulator has declared floor RVP levels during summer months.

Both operational and environmental concerns motivate the seasonal switch of gasoline's RVP level. Refiners achieve this by modifying the blend of products which make up the gasoline mix. Those seasonal switches are anounced by the refiners and their effective availability will depend as well on the pipeline scheduling cycles. Hence in a given delivery month two qualities may coexist. Agencies usually refer the lowest RVP delivered as 'prompt' (current) and the highest (phasing out entering summer, phasing in entering winter) as 'supplemental'. Dates and RVP levels vary, but it is approximately along the schedule outlined in the table below. More quotes may exist (winter, summer, continuous, transition) but the exact dates and RVP levels vary per region and season, hence exact specifications should at all times be verified.

| Dates | RVP (psi) | |

|---|---|---|

| Main | Supp | |

| Jan, Feb | 15.0 | - |

| Late Feb, Early Mar | 13.5 | 15.0 |

| Early Apr | 9.0 | 13.5 |

| Apr, Sep | 9.0 | - |

| Early Sep | 9.0 | 13.5 |

| End Oct | 13.5 | 15.0 |

| Nov, Dec | 15.0 | - |

Sulfur impurities make crude oil toxic and corrosive. They need to be removed in the refinery process to obtain derived products satisfying operational tresholds and compliant with environmental regulations, which become increasingly restrictive. It thus increases the refining cost.

| Product | Grade | Sulfur | |

|---|---|---|---|

| pct | ppm | ||

| Crudes | Sour | > 0.50 | > 5000 |

| Sweet | < 0.50 | < 5000 | |

| Products | Low sulfur (LS) | < 0.05 | < 500 |

| Ultra low sulfur (ULS) | < 0.0015 | < 15 | |

The density of a substance is its mass per unit of volume. Density will change with changes in pressure or temperature. Increasing pressure will increase density, increasing temperature usually decreases it. Hence density measurement must happen in well defined pressure and temperature conditions.

The SI unit for volumetric mass density is kg/m3. But what is often expressed is relative density (also called specific gravity), which is a ratio of the density of a given material to a reference material density, and hence becomes dimensionless.

Often applied in oil assessments are:

| Unit | Measure |

|---|---|

| Density |

The SI measure of density in kg/m3 of g/l. Water at 4°C expressed in SI unit has a density of 1,000 (or 1kg per liter). Most oil products will be a bit below, in other words they 'float' on water. |

| API |

The American Petroleum Institute has worked out a density measure which is widely adopted in crude assessments. It measures the specific gravity (SG) or the density of an oil liquid relative to that of water. Water at 60°F (15.5°C) has a specific gravity of 1, which results in 10° API. The lighter the oil, the greater the API degree. |

| Conversion factor |

For practical reasons, specific gravity is often expressed as a conversion factor between quotation and delivery unit, typically barrel (BBL ≈ 159 liter) to metric ton (MT). |

Based on API, crudes usually are categorized as (bucketing may vary between classifications):

| Grade | Density | |

|---|---|---|

| API | kg/m3 | |

| Light | > 31.1° | < 870 |

| Medium | > 22.3° | < 920 |

| Heavy | > 10.0° | < 1000 |

| Extra heavy | < 10.0° | |

For a fuel to qualify as a renewable fuel under the RFS program, EPA must determine that the fuel qualifies under the statute and regulations. Among other requirements, fuels must achieve a reduction in greenhouse gas (GHG) emissions as compared to a 2005 petroleum baseline.